Office of Alumni Relations

Early-Myers Development House

One University Place

Murfreesboro, NC 27855

Murfreesboro, NC 27855

All Together, For Life

Alumni Verification

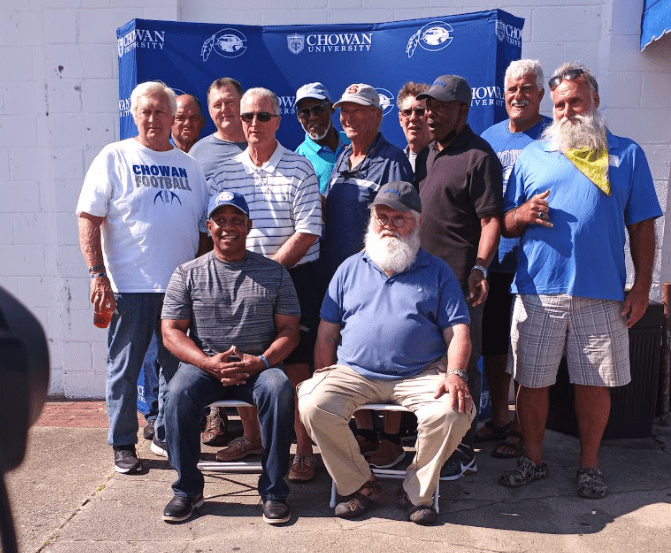

Chowan University recently launched a comprehensive alumni verification project in preparation for our 175th Anniversary. Our 175-anniversary celebrations will begin on October 11, 2022 (Chowan’s 174th birthday) and run through Homecoming 2023.

We’ve assembled the information currently listed in our alumni files and need your help to confirm the accuracy of your record and fill in any information gaps. We are also collecting stories from our alumni to memorialize the history of the campus experience through the years.

We have partnered with PCI for this – please call (800) 403-8792 to update your information and participate in this historic event.

We appreciate your assistance in this endeavor.

We’ve assembled the information currently listed in our alumni files and need your help to confirm the accuracy of your record and fill in any information gaps. We are also collecting stories from our alumni to memorialize the history of the campus experience through the years.

We have partnered with PCI for this – please call (800) 403-8792 to update your information and participate in this historic event.

We appreciate your assistance in this endeavor.

When you’re part of the Chowan community, the experience lives on well beyond your college years. Together we’ll keep growing, learning, soaring. Discover all the possibilities for your life, for a lifetime.

Chowan Alumni Relations is the University’s official alumni engagement program dedicated to celebrating the memories, experiences, and connections of Chowan.

Stay

Connected

It’s easy to get involved!

There are many ways to stay connected to life at Chowan.

News

Featured News

Chowan University announces the retirement of esteemed basketball coach and professor Jim Hammond. After 16..

Chowan University welcomed back Qeashaunda Johnson, a member of the class of 2018, on April..

Upcoming Events

Ways to give

Make your gift over the phone by calling 252-398-1233 any business day between 8:30 a.m. – 5:00 p.m.

To make a gift by mail send your check or money order to:

Chowan University

Office of Advancement

One University Place

Murfreesboro, NC 27855

Visit us in person any business day between 8:30 a.m. – 5:00 p.m or by appointment at the Early-Meyers Development House.